Ukraine and Russia are both major exporters of foodstuffs and fertilisers. Consequently, Russia’s invasion of Ukraine in February 2022 led to fears of an impending food crisis, particularly in the Middle East and North Africa. Prices did indeed rise steeply in March 2022 as Russia blockaded Ukrainian ports.

Although global food prices remain elevated, they have fallen over the past year. This is partly due to mitigating measures, particularly the Black Sea Grain Initiative (BSGI). However, prices were already high before the war due to the effects of the Covid-19 pandemic.

The BSGI was further extended in March until May 2023 at least. Each deadline gives Russia a new opportunity to press for concessions on sanctions, as Ukraine sorely needs the export revenues, and there is ongoing concern regarding world food prices.

While a continuation of the BSGI is highly preferable, it is also important to note that the initial food crisis fears were somewhat overblown. Russia’s leverage is limited. Higher food prices do take a toll on the poorest, but world food markets also have a high degree of flexibility and thereby resilience. Scuttling the deal would also incur costs for Russia and is therefore unlikely to happen.

Introduction

As the full extent of Russia’s invasion of Ukraine in February 2022 sank in, the heavy fighting quickly led to warnings of an impending global food crisis. The Middle East and North Africa, as well as the Horn of Africa, were a particular concern. This was due both to the major role of Ukrainian and Russian agricultural exports in the region as well as widespread pre-existing food insecurity and the potential for civil unrest.

One year on, global hunger remains a huge problem and it is causing grave human suffering, especially to those in the most vulnerable positions in regions afflicted by drought as well as conflict. Yet it seems clear that the impact of the war in Ukraine has been limited. Food prices peaked in March 2022 but have been on the decrease ever since. This has been partly due to mitigating measures, chiefly the Black Sea Grain Initiative (BSGI), which reopened Ukraine’s Black Sea ports for food exports in July 2022. However, it is equally clear that initial fears were somewhat overblown. With the BSGI up for periodic renewal, it is useful to take a closer look at what it has accomplished in the context of larger export and price trends.

This FIIA Briefing Paper firstly looks back at the spring of 2022 and the reasons why a food crisis seemed imminent. It then examines the mitigating measures taken in the form of EU Solidarity Lanes and the BSGI. Finally, it assesses all of this in light of export and price trends. This provides tools for putting the BSGI in context. The deal is very important, but by no means the only factor determining global food prices or regional shortages. Russia’s leverage is ultimately limited, as global food markets have quickly adapted to the new situation.

Looking back in hunger - Fears of a 2022 food crisis

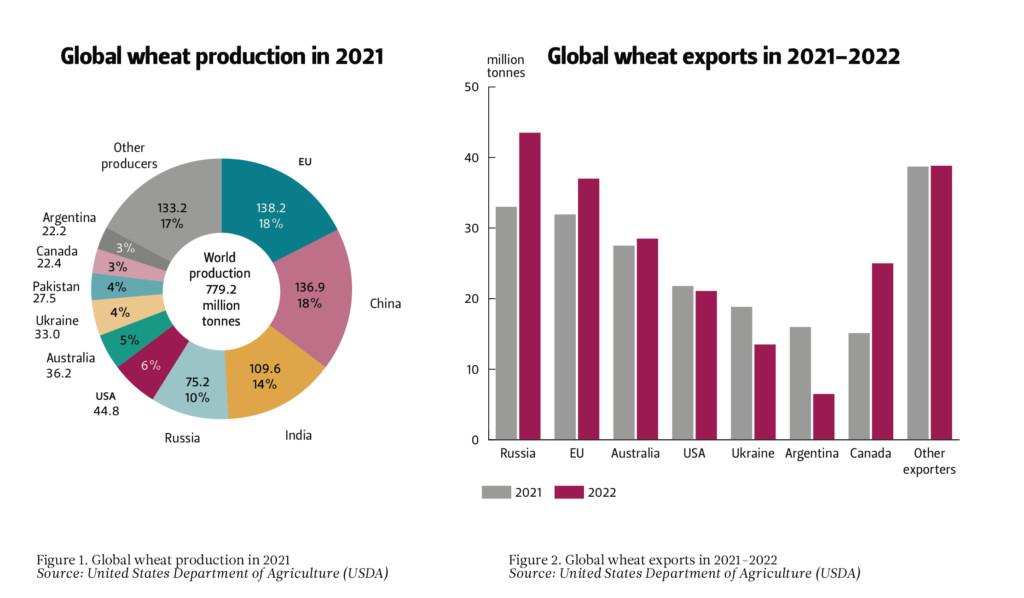

Fears of an impending food crisis, voiced frequently in March–June 2022, were based on the exceptional nature of the northern and eastern Black Sea region. Ukraine and Russia, particularly areas in southwestern Russia near Ukraine, are veritable breadbaskets. Both produce staples such as wheat, maize, barley, sunflower seeds, sunflower oil, rapeseed and rapeseed oil, and are also exporters with a significant share of the global food market (see Figure 1). Russia is also the world’s top exporter of several types of fertiliser.

Production rankings do not of course directly translate into export rankings, as many of the world’s largest producers consume or stockpile a very high share of their own production domestically. For instance, the world’s largest wheat producer, China, exports practically no wheat at all. Consequently, the international market for wheat is dominated by a relatively small number of states.

In 2021, Russia, the EU, Australia, the US, Ukraine, Argentina, and Canada together produced 80 per cent of the over 200 million tonnes of wheat sold internationally (see Figure 2). Russia was the single largest global exporter of wheat with a total of 33 million tonnes, while Ukraine was in fifth place with 19 million tonnes. Combined, the over 50 million tonnes of wheat that Russia and Ukraine sold that year made up a quarter of the global market, estimated to be worth 55.8 billion USD. As for maize (corn) exports, Ukraine was in fourth place and Russia in seventh, with Ukraine alone accounting for roughly 13 per cent of global maize exports.[1]

Given the importance of Ukraine and Russia for the global food market, there were fears that the war would result in a dramatic drop in production in Ukraine. As for Russia, Western sanctions excluded food and fertilisers, but the secondary effects of other sanctions were estimated to nevertheless lead to a decrease in the country’s agricultural exports.[2]

Ukrainian wheat is predominantly winter wheat, meaning that the crops were planted as usual in 2021. The planting of spring crops was soon hampered by the Russian invasion in February as was the harvest season for the winter crops in July–August 2022. Some fields lay in areas occupied by Russia while others were too dangerous to access as they were in the immediate vicinity of the long frontlines. Still others were rendered unsafe due to landmines and unexploded ordinance (UXO). Some estimates put the area contaminated by mines and UXO as high as 30 per cent of Ukrainian territory by as early as September 2022. The situation was particularly dire for wheat production, as it is concentrated in the east and south of the country.[3]

In April 2022, the UK Defence Intelligence estimate was that Ukraine’s grain harvest would be around 20 per cent lower than the previous year. In June, the Food and Agriculture Organization of the United Nations (FAO) warned that as much as 20–30 per cent of winter crops might remain unharvested in Ukraine.[4]

In addition to fears of crops left unharvested, Ukraine’s ability to transport its agricultural produce was also cast into doubt. Around 90 per cent of food exports from Ukraine used Black Sea shipping lanes. Russia had already occupied Crimea in 2014 and was in full control of the mouth of the Sea of Azov at the Kerch Strait. Soon after the February 2022 invasion, its navy was also blockading the northwestern Black Sea ports, such as Odesa, which remained in Ukrainian hands. Ukrainian shipping came to a standstill. River and road routes to the European Union were open but could not offer anything close to the same capacity.

To sum up, the Russian invasion put the Ukrainian harvest at risk and a deliberate Russian blockade prevented Ukrainian food exports of whatever could be salvaged from the harvest. This was of consequence particularly in the Middle East and North Africa (MENA), as well as the Horn of Africa.

In recent years, much of the exported Russian and Ukrainian wheat has been sold to the MENA region and the Horn of Africa, which contain many of the world’s top wheat importers. Egypt, Turkey, Algeria and Iran were all among the six largest importers of wheat in the world in 2021, with Morocco, Yemen, Saudi Arabia and Iraq also significant. Together, these countries imported 49 million tonnes of wheat in 2021, roughly a quarter of total international wheat sales.[5] Additionally, countries in the Horn of Africa imported their wheat predominantly from Russia and Ukraine.

Food insecurity in these regions was already a significant issue. Many medium-income states in the MENA region are heavily import-dependent with fast growing populations and high poverty levels. A third of Egypt’s population of roughly 109 million live below the income poverty line. As the country’s diet is heavily wheat based, fluctuations in wheat prices have a great impact. In Lebanon, the massive blast at Beirut’s port in August 2020 left many of the city’s grain silos badly damaged, destroying stockpiles and limiting the ability to store new grain.

Russian wheat has been sold particularly to Egypt and Turkey, and these two top wheat importers have also been major buyers of Ukrainian wheat. Lebanon has imported 80 per cent of its wheat from Ukraine and a further 15 per cent from Russia. Libya imported over 40 per cent of its wheat from Ukraine. Syria, listed as a Low-Income Food-Deficit Country (LIFDC) by FAO, imported wheat mainly from Russia, but northwest Syria, which is currently not under government control, receives its wheat from Turkey, which in turn imports it from Ukraine and Russia. Extremely food-insecure Yemen, also listed as LIFDC and a Least Developed Country (LDC), also imported 27 per cent of its wheat from Ukraine.[6]

A further concern was the memory of the Arab Spring of 2011. A common but also contested interpretation in the years that followed was that the large-scale social unrest was partially fuelled by food prices increasing 40 per cent over the course of 2010. The implication was that a similar rapid rise in prices would create not only economic problems and human misery, but also provoke potentially widespread political unrest with all its related consequences.

Navigating blockades - Mitigation by reopening trade routes

The food crisis materialised almost immediately in the form of dramatically increased prices. The price of grain shot up by nearly 50 per cent almost as soon as the war began. In Egypt, for example, this resulted in non-subsidised bread prices increasing by nearly 50 per cent as well. The government responded by introducing price controls but faced increasingly steep costs for maintaining its food subsidies.[7]

The price rise happened very quickly in February–March 2022. This was of course months before the harvest, but cereals are stored in siloes and exported throughout the year. As 90 per cent of Ukraine’s grain exports had left the country through its ports, the sea blockade soon brought Ukraine’s grain trade to an end. Even so, the rapid rise in food prices was not so much a reflection of the actual decrease in the global grain supply, but rather changed expectations, as well as speculation in grain futures.[8]

The disconcerting developments underlined the need to find alternatives to the Black Sea shipping routes that Russia was blockading. In May 2022, the European Commission announced that it was establishing Solidarity Lanes to expedite both Ukrainian exports as well as the imports the country needed, including fertilisers for its agriculture. These Solidarity Lanes aimed at improving both road and rail transport connections with the EU. This would enable circumventing the blockade by using seaports in EU countries, such as Romania’s more southern Black Sea port of Constanța as well as North Sea and Baltic Sea ports in Germany, Poland and Lithuania.

The Commission’s action plan for the Solidarity Lanes identified bottlenecks such as insufficient capacity of transhipment terminals, a shortage of available lorries, various delays resulting from border checks and customs, as well as other shortcomings in transport networks. Further complications arose from the difference between Ukrainian broad-gauge railways and the narrower EU standard gauge. A substantial rerouting of massive agricultural exports presented significant logistical challenges.[9]

It has been clear from the outset that the EU Solidarity Lanes could not fully compensate for the loss of Black Sea shipping. This is true at least in the short to medium term with regard to capacity, and it will always be true in terms of expense. Transport by sea is simply more cost-efficient. Although Ukrainian food and fertiliser exports to and via the European Union are significant, a backlog was steadily building up.

A breakthrough was reached in July 2022 in the form of the Black Sea Grain Initiative (BSGI), proposed and facilitated by the UN, and signed by Ukraine, Russia, and Turkey. The initiative allows Ukraine to resume exporting food and fertilisers via three of its Black Sea ports, namely Odesa, Chornomorsk, and Yuzhny/Pivdennyi. A connected deal aimed at removing existing obstacles to Russia’s export of similar products.

The initial run of the deal was 120 days, ending in November 2022. According to the agreement, it would automatically be renewed for a further 120 days unless any of the parties specifically objected. Russia did in fact object in late October, but resumed its participation only days later, after which the next 120-day period ran until March 2023. While Ukraine, Turkey and the UN have been keen to allow the deal to continue, Russia again raised objections in the run-up to the 18 March deadline.

The difficulties seem to have revolved around Russian attempts to gain relief from some of the indirect effects that sanctions are having on its food and fertiliser exports. Although these products are exempted from sanctions, the companies trading in them face various sanctions-related hurdles in moving funds.

Ultimately, Russia signalled that it would only agree to a 60-day extension, namely until May 2023, and it was still unclear after the extension had been announced whether it was in fact for 60 or 120 days. If not in May, BSGI talks will resume at the latest in July.

The significance of the BSGI has been tangible for all involved. For Turkey, it has been a major diplomatic achievement, showcasing its ability to talk with both sides of the war. For Ukraine, it has brought in significant and sorely needed export revenues. The UN is concerned about world food prices, which dependable Black Sea shipping will help keep in check. Indeed, the UN has been heavily invested in keeping the shipping lanes open and ensuring that Ukrainian foodstuffs reach global markets. The same has been true of Western countries generally. Insofar as they support Ukraine, keeping the country’s largest export sector operational is vital and cost-efficient.

For this very reason, the BSGI has presented Russia with an opportunity for outright blackmail. Russia has been able to use the deal to achieve a parallel memorandum with the UN, which aims at facilitating unimpeded access to global markets for Russian grain and fertiliser exports. The periodic renewal of the deal provides Russia with recurring opportunities to press for more sanctions relief or other concessions.

Nevertheless, while Russia has been happy to play difficult in mitigating a crisis of its own making, it would also pay a price for scuttling the deal. Although the war and the blockade have been initiated and pursued by Russia, the BSGI provides it with a way to avoid blame for increased global food prices and the resulting food insecurity in developing countries. A failure of the BSGI would also directly impact countries such as China and Turkey, which are the largest and third-largest recipients, respectively, of Ukrainian cargo shipped under the deal. For Turkey in particular, this is important, and it has also invested considerable diplomatic capital in mediating the BSGI. For Russia, Turkey has become an increasingly important trading partner and a key supplier of technology that it now has difficulties importing from elsewhere. This has given Turkish concerns added weight in Moscow.[10]

A grain of truth – Assessing the past year

After more than a year in, the impact of the war in Ukraine on world food markets is real. However, the effect is not as dramatic or nearly as straightforward as often assumed in the spring of 2022. The analysis at the time was based on several solid facts but also, as it turns out, a few mistaken assumptions, overly negative expectations, and a degree of alarmism.

First of all, it seems that Russian food exports have not been seriously impacted. Russia is waging its war exclusively in Ukraine, meaning that there is no direct damage to Russian fields or export infrastructure. Russian grain and fertiliser exports are excluded from sanctions and the parallel memorandum to the BSGI aims at facilitating unimpeded access to global markets. While Russia complains that there are issues with this, it does not seem to impact the overall picture unduly. Indeed, while direct data is no longer available, estimates suggest that Russian wheat exports for 2022 surpassed the already high 2021 levels, buoyed by a bumper crop.[11]

Secondly, despite not having access to substantial parts of the east of the country, Ukraine’s wheat harvest in 2022 was significantly better than expected. While there was a clear drop from the previous year, it should be noted that the harvest for 2021 was record high. In fact, despite the war, the 2022 wheat harvest was only around five per cent below the five-year average.[12] Furthermore, while the wheat in the east of the country was harvested under Russian occupation and represented a loss for Ukraine, it nevertheless found its way into the export market through Russian channels and thereby contributed to overall global supply.

In view of the above, the most substantial direct effect of the war, from the point of view of agricultural products, has been in constraining Ukrainian exports. This was particularly acute in March–July 2022, before the signing of the BSGI (see Figure 3). The capacity of land and river transport routes is not negligible and continues to be further improved, but has not been able to make up for a lack of sea transport. Even since the signing of the BSGI, the backlog has not been removed and ports are still not operating at 2021 levels. However, the effect has not been nearly as dramatic as estimated. According to the WTO, the overall decline in Ukraine’s cereal exports over the past year has been only 14.9 per cent.

This is due to the combined effect of a resumption of Black Sea shipping and improvements in land routes. However, as long as shipping capacity is not at pre-war levels, pressure on the land routes remains. This has had the unintended consequence of depressing grain prices in countries bordering Ukraine. Instead of transiting further on, cheaper Ukrainian grain has undercut local producers, causing bitterness amongst farmers in Poland in particular. On 15 April both Poland and Hungary announced a temporary halt in imports of Ukrainian food products. Until a solution is found, this will effectively close many of the EU Solidarity Lanes and place more pressures on the Black Sea route.

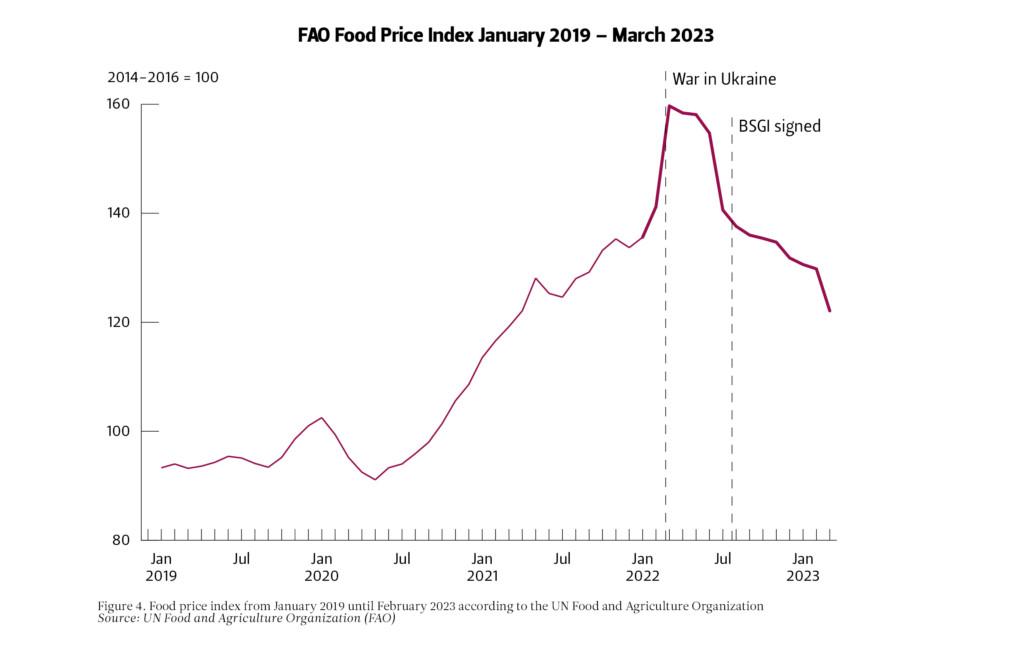

FAO’s global food price index peaked in March 2022, but it has been in continuous decline ever since, even before the BSGI was signed, let alone took effect (see Figure 4). Currently, levels are back to what they were in the late summer of 2021. However, this is still high. Food prices have been at an already elevated level from 2020 onwards due to the Covid pandemic. This has had the effect of increasing trade values in food staples even when overall trade volumes remain stable, which has benefitted exporters and helped Ukraine make up for lost trade volume in trade value.

The relatively small drop in the volume of Ukrainian cereal exports must be seen in the context of the global trade in food, in which supply regularly fluctuates and demand can shift in response to prices. For example, in the Middle East and the Horn of Africa, major importing countries such as Egypt and Ethiopia have successfully found new suppliers of wheat to make up for a drop in Ukrainian exports. In Ethiopia’s case, Ukraine supplied 31 per cent of the country’s wheat in 2019 and almost none in 2022. Instead, wheat was purchased from the United States and Argentina. Turkey made up for a lower level of expensive wheat imports by importing more rice.[13]

Consequently, the reopening of Ukrainian ports from July 2022 did not mean nor necessitate a large volume of food exports to the Middle East and North Africa. The significance of the BSGI has been in keeping the overall volume of trade at close to pre-war levels, which has eased pressures on prices. Trade patterns on the other hand have shifted flexibly. Indeed, only 15 per cent of the entire tonnage shipped out under the BSGI has gone to the Horn of Africa and the entire MENA region from Morocco to Iran and Yemen. In terms of tonnage, Spain has received more on its own. In total, 25.2 million tonnes of food products have been shipped out so far, and the single largest destination has been China (5.6 million tonnes), followed by Spain (4.4 Mt), Turkey (2.7 Mt), Italy (1.8 Mt) and the Netherlands (1.6 Mt). These five destinations alone account for two-thirds of the entire tonnage.[14]

Conclusions: Black Sea to stay open, global hunger remains

Fears about the war in Ukraine leading to catastrophically increased food insecurity in the MENA region and the Horn of Africa did not materialise. To be sure, a global food crisis is nonetheless underway. The UN World Food Programme (WFP) has projected that globally, from Haiti to Afghanistan, around 345 million people will be food insecure in 2023 and several countries in the MENA and Horn of Africa regions are in dire straits.

This alarming situation has several local drivers, such as armed conflicts in Yemen, Syria and Ethiopia. The ongoing climate crisis is also a major factor driving the food crisis and will only get worse. On top of this, the rise in fertiliser and food prices, firstly due to the Covid-19 pandemic and then the war in Ukraine, have added to the misery. Fortunately, the latter did not have nearly as severe an additional impact as was feared.

This was partly due to the reopening of the Black Sea through the BSGI, but the initial fears turned out to be exaggerated even in its absence. Food prices were already high before the war in Ukraine, and the increase immediately after the start of the war reflected uncertain expectations. Prices started decreasing very soon after the invasion as alternative suppliers were found, consumption patterns changed, and markets adjusted.

The effect of the BSGI has largely been indirect, that is, in adding to market confidence and overall supply, and thereby lower prices. When Ukrainian ports were blockaded in February–July 2022, buyers found new suppliers. When the ports reopened in July 2022, Ukrainian food products found new markets. Nevertheless, the increased, more dependable and less costly supply of foodstuffs enabled by Black Sea shipping from Ukraine has contributed to a steady post-Covid decline in global food prices. This is important, as even modest price fluctuations affect food-insecure populations.

The current situation can be expected to continue as long as the BSGI remains in force. However, the deal needs to be periodically extended, which affords regular opportunities for Russian blackmail. If Russia were to suspend the BSGI, for example in May 2023 after its current half-extension ostensibly expires, or at some later date, it would create severe bottlenecks for Ukrainian exports and have a knock-on effect on world food prices. Still, considering the experiences prior to the BSGI, the effect will be limited. The most vulnerable buyers have already found new suppliers, land and river connections to the EU mean that Ukrainian exports will not fall to zero, and several countries have the means to at least temporarily increase their export capacity to compensate. Market logic suggests that this is indeed what will happen when prices rise, which will in turn help supress them again. It is likely that the shock to price expectations resulting from a suspension of the BSGI would be lower than what was experienced in early 2022.

We have seen that global food markets are relatively flexible and thereby resilient. The continuation of the BSGI is highly preferable, both from the point of view of global food supply and Ukrainian export revenue. The continuation of the BSGI is also the most likely scenario, although Russia can be expected to use threats of walking away from it to gain concessions.

The continuation of the BSGI is clearly in the interests of Ukraine. Turkey is also heavily invested in it both as a major diplomatic feat but also as a significant buyer of Ukrainian food, and with an economy in the throes of a severe cost of living crisis that would be adversely impacted by any further price hikes. The UN strongly supports the BSGI as a way of improving food security. Russia also stands to gain from continuing the BSGI in the form of the parallel memorandum on its own exports, as well as the regular opportunity to push for more. While it will threaten to scuttle the deal, actually doing so would alienate Turkey and put Russia on the back foot in the global blame game over higher food prices. For all these reasons, the Black Sea will likely remain open for the grain trade.

Endnotes

[1] USDA (2023a) “Commodity Explorer”. U.S. Department of Agriculture, Foreign Agricultural Service, March 2023. https://ipad.fas.usda.gov/cropexplorer/cropview/Default.aspx.

[2] FAO (2022) “The Importance of Ukraine and the Russian Federation for Global Agricultural Markets and the Risks Associated with the War in Ukraine”. Food and Agriculture Organization of the United Nations, Information Note, 10 June 2022. https://www.fao.org/3/cb9013en/cb9013en.pdf.

[3] Klain, Doug (2022) “Russia Is Seeding Ukraine’s Soil With Land Mines”. Foreign Policy, 15 September 2022. https://foreignpolicy.com/2022/09/15/russia-ukraine-land-mines/; USDA (2023b) “Ukraine: Wheat Production”. U.S. Department of Agriculture, Foreign Agricultural Service, March 2023. https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Ukraine/Ukraine_wheat.jpg.

[4] Reuters (2022) “UK says Russia's invasion of Ukraine has disrupted Ukrainian agricultural production”. Reuters, 26 April 2022. https://www.reuters.com/world/europe/uk-says-russias-invasion-ukraine-has-disrupted-ukrainian-agricultural-production-2022-04-25/; FAO 2022.

[5] USDA (2023c) “Wheat explorer”. U.S. Department of Agriculture, Foreign Agricultural Service, March 2023. https://ipad.fas.usda.gov/cropexplorer/cropview/commodityView.aspx?startrow=1&cropid=0410000&sel_year=2021&rankby=Imports.

[6] HRW (2022) “Russia’s Invasion of Ukraine Exacerbates Hunger in Middle East, North Africa: Strong Government Response Needed to Protect the Right to Food”. Human Rights Watch, 21 March 2022. https://www.hrw.org/news/2022/03/21/russias-invasion-ukraine-exacerbates-hunger-middle-east-north-africa.

[7] Reeves, Nicolas (2022) “Wheat Supply Bottlenecks Pose Fiscal Challenges for Egypt”. Foreign Brief, 9 June 2022. https://foreignbrief.com/analysis/wheat-supply-egypt/.

[8] See e.g. Nikkanen, Hanna (2022) “Ruoan hinta”. Long Play, 29 September 2022. https://www.longplay.fi/pitkat/ruoan-hinta.

[9] European Commission (2022) “An action plan for EU-Ukraine Solidarity Lanes to facilitate Ukraine's agricultural export and bilateral trade with the EU”. Communication from the European Commission, 12 May 2022. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52022DC0217.

[10] Prokopenko, Alexandra (2022) “Russia’s Return to Grain Deal Is a Sign of Turkey’s Growing Influence”. Carnegie Endowment for International Peace, 8 November 2022. https://carnegieendowment.org/politika/88349.

[11] Fastmarkets (2023) “Russia’s wheat export pace overtakes 2021’s despite challenges”. Fastmarkets, 5 January 2023. https://www.fastmarkets.com/insights/russias-wheat-exports-overtake-2022.

[12] Mitkish, Mary and Voiland, Adam (2022) “Larger Wheat Harvest in Ukraine Than Expected”. Earth Observatory, NASA, December 2022. https://earthobservatory.nasa.gov/images/150590/larger-wheat-harvest-in-ukraine-than-expected.

[13] WTO (2023) “One year of war in Ukraine: Assessing the impact on global trade and development”. World Trade Organization, 2023. https://www.wto.org/english/res_e/booksp_e/oneyukr_e.pdf.

[14] JCC (2023) “Vessel Movements”. Black Sea Grain Initiative Joint Coordination Centre, March 2023. https://www.un.org/en/black-sea-grain-initiative/vessel-movements.