India ranks fourth in the world in terms of installed renewable energy capacity, with goals to further increase non-fossil fuel-based electric power capacity to 50% by 2030 and achieve net-zero emissions by 2070. However, its goals are dependent on a reliable and sustainable supply of critical minerals.

Geopolitically, India’s critical minerals strategy is influenced by international dynamics and its systemic rivalry with China. India is therefore cooperating and collaborating with the United States, Australia, the European Union, Argentina, Chile, the Quad, the G20, and other actors to secure reliable supply chains for critical minerals.

India is implementing regulatory and structural reforms to boost domestic production by increasing private investment and auctioning critical mineral blocks. At the same time, it requires immense financial and technological investment to advance this domestic strategy.

To mitigate the risks associated with supply chain disruptions, India is set to strengthen its complementary two-pronged approach of boosting domestic production and pursuing international partnerships.

Introduction

India’s critical minerals strategy is emerging as a pivotal element in the country’s broader geopolitical and clean energy ambitions. Critical minerals such as lithium, cobalt, copper, nickel, and rare earth elements (REEs) play a crucial role in this transition, serving as essential components in the manufacture of batteries, wind turbines, solar panels, and other green technologies. The demand for these minerals is surging, with projections indicating a substantial increase in the coming decades, challenging the global supply chains, and highlighting the importance of sustainable mining practices.

Recognizing the geopolitical implications of mineral dependency, India is seeking to mitigate its reliance on dominant suppliers such as China, which currently holds substantial sway over the global critical minerals market. By prioritizing the development of a resilient and self-reliant supply chain for critical minerals, India not only seeks to safeguard its national security and economic prosperity, but also aspires to position itself as a key player in the global clean energy domain.

This Briefing Paper discusses India’s critical minerals strategy in the context of its energy transition outlook, unpacks its domestic and international imperatives and policies, and examines the challenges to this strategy. The paper argues that India’s energy transition goals and geopolitical imperatives have spurred its two-fold critical minerals strategy of bolstering domestic exploration and production capacities and securing diversified international supply chains through strategic partnerships.

India’s energy transition outlook

Despite India’s heavy reliance on coal to meet its energy requirements, the country has taken several steps towards advancing and achieving renewable energy goals, especially in sectors such as electricity, transportation, industry, and buildings. For India, renewable energy is regarded as an important component of its energy security, considering its longstanding dependence on fossil fuel imports to meet its energy requirements.

India currently ranks fourth in the world in terms of installed renewable energy capacity, fourth in wind power capacity, and fifth in solar power capacity. Over the past decade, the Government of India and various sub-national stakeholders have enforced several policies that have resulted in an increase in the country’s renewable energy capacity from 81 GW a decade ago to 188 GW today. In the transportation sector, India has set a goal of raising the share of electric vehicle (EV) sales to “30 percent in private cars, 70 percent in commercial vehicles, 40 percent in buses, and 80 percent in two-wheelers and three-wheelers by 2030”. This implies a target of 80 million EVs by 2030.[1]

India’s climate action targets:

-

-

-

-

- Reduce emissions intensity of its GDP by 45 percent by 2030, from the 2005 level.

- Achieve about 50 percent of cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030.

- Generate 500 GW of installed non-fossil fuel power generation capacity by 2030.

- Reach net-zero emissions by 2070.

-

-

-

Sources: Various government ministry websites

However, India missed its 2022 175-GW renewable energy target by 55 GW. In 2023, it managed to install only 13.7 GW of clean energy, while the 2030 target necessitates at least 40 GW of installed clean energy capacity annually. The reasons for this failure included COVID-19-related supply chain disruptions, import tariffs on key renewable energy components, and increased prices of critical raw materials.[2] India imposed customs duties of 40 percent on solar modules and 25 percent on solar cells in 2022 to reduce imports from China and boost domestic production. As a result, its Chinese solar imports decreased by USD 2 billion (80 percent) in 2023, but this move limited India’s renewable energy capacity expansion.

Estimates suggest that “India could become the world’s second-largest solar PV [photovoltaics] manufacturer by 2026 with a module production capacity of 110 GW”.[3] However, efforts to build self-reliance in the renewable energy sector by incentivizing and promoting domestic manufacturing will take some time, as India continues to balance between its climate and energy goals on the one hand, and its geopolitical imperatives of reducing dependence on its geopolitical rival, China.

Critical minerals and geopolitical entanglements

China’s supremacy in the mining, processing, and refining of critical minerals positions it at the heart of the global supply chains for renewable energy technologies. This presents significant risks, including supply disruptions and geopolitical strongarming, as in the case of a de facto Chinese embargo on REE export to Japan in 2010 over the Senkaku/Diaoyu Islands dispute. Beijing’s strategic control over these resources has prompted other countries to explore alternative sources and invest in domestic capabilities to reduce dependency – spurring many actors, including the United States, Japan, Canada, the European Union, and Australia, to introduce policies to diversify and derisk their supply chains.

Geopolitical tensions, such as the US-China rivalry, have manifested in trade wars, technology competition, and concerns over the security of critical mineral supplies. Similarly, the instability in the Democratic Republic of Congo (DRC), a major producer of cobalt (a key mineral for energy transition), and tensions in the South China Sea, a vital shipping route, further complicate the global critical minerals supply chain. In the case of the DRC, China has emerged as a strategic player in its cobalt mining sector, adding to the geopolitical complexity of the global energy transition. At the same time, the violations of human and labour rights and environmental regulations associated with mining have raised concerns about the human and ecological insecurities linked with the transition.[4] Moreover, other countries with an abundance of essential critical minerals are seeking greater benefits from their resources. This is exemplified by the potential increases in mining taxes and nationalization efforts in Chile and Mexico, which could lead to further supply chain uncertainties.

India’s critical minerals strategy: Domestic imperatives

Given India’s immense dependence on critical mineral imports (see Table 1), its push to bolster critical mineral capacity domestically has seen significant advancements, notably the recent discovery of lithium reserves in the state of Jammu and Kashmir. With an estimated 5.9 million tonnes of “inferred” lithium deposits, it marks India’s first known source of the metal, which is essential for batteries in electric vehicles and renewable energy storage systems.[5] India is focused on ramping up exploration and extraction efforts for critical minerals within its own territory to promote self-reliance in critical mineral supply chains, particularly having learnt lessons from fossil fuel-related supply chain disruptions in the past.

The Government of India has identified 30 minerals as critical, reflecting its intent to secure supply chains for these materials, which are pivotal for India’s burgeoning high-tech, defence, and clean energy sectors. Lithium, cobalt, and REEs are at the forefront of this critical minerals strategy.[6] India has also taken some important regulatory and structural steps to boost domestic production of critical minerals. For instance, the government has amended the Mines and Minerals (Development and Regulation) Act to make it easier for the private sector to explore and mine strategic minerals like lithium and cobalt, streamline auction processes, and introduce exploration licences.

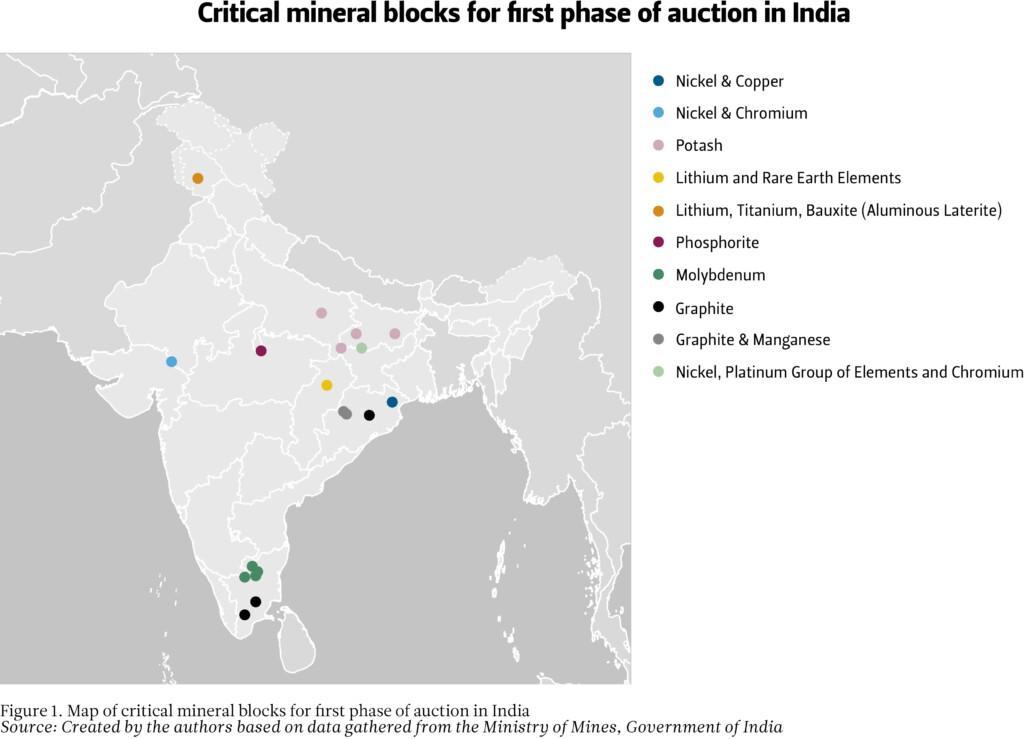

As part of its comprehensive critical minerals strategy, India recently auctioned 20 critical mineral blocks, involving bids from both state-owned and private mining companies such as Coal India and Vedanta. Figure 1 presents a map depicting the locations of auctioned critical mineral blocks in India. It has also established a public sector undertaking called Khanij Bidesh India Ltd. (KABIL) to secure a reliable supply of critical minerals from other countries. Further, the states of Karnataka and Rajasthan launched an Exploration Licence for critical and deep-seated minerals in 2024, with some other states following suit. The strategy also included the establishment of the National Mineral Exploration Trust (NMET) in 2015 and the setting of reduced royalty rates. These reforms have also enhanced the revenues of some mineral-rich Indian states such as Odisha, Chhattisgarh, and Jharkhand, which are also the country’s largest coal producers. Hence, this could also be an equitable energy transition pathway for these states, as their economies diversify their revenue sources and gradually wean themselves off coal dependence.

India’s critical minerals strategy: International cooperation

India is actively seeking to forge international partnerships, such as its collaboration within the Quad (with the US, Japan, and Australia) on framing principles on clean energy supply chains in the Indo-Pacific. It is also making direct agreements with countries like Australia, which are rich in critical mineral resources. In June 2023, India was welcomed into the Minerals Security Partnership (MSP), a group committed to building a secure supply chain for critical minerals. The MSP, a US-led initiative, brings together like-minded countries to foster resilient supply chains, promote sustainable and responsible mining practices, and reduce dependency on single-source suppliers, notably China. This move was influenced by India’s market size, its instrumentality in global climate governance (especially with its growing greenhouse gas emissions), and its representation as one of the main voices of the Global South. India’s participation is significant for the MSP’s efforts to ensure a stable supply chain unaffected by disruptions such as the COVID-19 pandemic or Russia’s war in Ukraine. Similarly, the EU has invited India to join the Critical Raw Materials Club, a forum proposed by the EU to bring together countries that have rich and poor deposits of critical minerals and to build trade channels that would help the Union reduce its dependence on China.

The MSP is not just about securing supplies; it is also perceived as a counterbalance to China’s dominance in the critical minerals market, aiming to mitigate vulnerabilities and ensure economic security for its members. India has a simmering border dispute with China, which has erupted into open military conflict on several occasions in the past five years. It also has many other threat perceptions concerning trade dependence, disinformation, transboundary waters, and an increasing Chinese presence in Southern Asia and the Indian Ocean region, among others. This systemic rivalry with its neighbour inevitably drives India to pursue its critical minerals strategy with greater urgency and vigour. The MSP could conveniently position India not only as an alternative to China, but also as a means of counteracting Chinese influence in the global supply chains. For India, it represents an opportunity to access the resources, technology, and investment needed to expand its own industrial base linked to these supply chains, which could also translate into achieving its ambitious renewable energy goals.

India’s collaboration with Australia, such as the 2022 Critical Minerals Investment Partnership involving five target projects (two lithium and three cobalt), is particularly noteworthy given Australia’s rich reserves of critical minerals such as lithium, cobalt, and REEs. This cooperation extends beyond mere resource acquisition, encompassing joint ventures in mining, processing, and research and development efforts aimed at innovation in mining technology and sustainable extraction practices. Australia’s expertise in critical minerals complements India’s vast market and industrial capabilities, creating a strong foundation for advancing mutual interests. Similarly, in 2021, India, Japan, and Australia launched the Supply Chain Resilience initiative, which seeks to identify alternatives to China in key sectors. Hence, the MSP and other similar initiatives will further fortify India’s collaborations with its Western partners in the strategic landscape around critical minerals – whether in terms of high-level policymaking or more project-specific cooperation.

Within the Global South, India has begun to actively engage with other resource-rich countries such as Argentina and Chile, be it through the MSP or outside of it. In January 2024, KABIL signed a USD 24 million deal with Argentina, involving the rights to explore and develop five lithium blocks in Catamarca, Argentina.

The road ahead for India’s critical minerals strategy

India’s critical minerals strategy, while ambitious, faces several hurdles. Technologically, the country needs to overcome a lack of advanced extraction and processing capabilities. This necessitates substantial investment in research and development to adopt and innovate technologies for sustainable mining and processing practices, as well as the cost-effective manufacturing and recycling of batteries. The establishment of centres of excellence and research institutes dedicated to critical minerals is part of the strategic plan to develop homegrown technological solutions and to position India as a leader in the critical minerals sector on the global stage. For instance, the government has recommended establishing a National Institute or Centre of Excellence on Critical Minerals (CECM), which will periodically update the list of critical minerals and inform the country’s critical minerals strategy.

It is estimated that India will require nearly 903 GW of energy storage to meet decarbonization targets in its electricity and transportation sectors by 2030, and steps to indigenize lithium-ion battery manufacturing would entail an investment of over USD 5 billion.[7] Similarly, as of now, India has only seven battery recycling plants that can extract reusable metals from spent batteries.[8] For a country whose extractable critical mineral reserves are currently limited, recycling is not only a sustainable opportunity but a necessity. These gaps could be bridged to some extent through international partnerships with technologically advanced countries willing to undertake joint research and innovation programmes and invest in India’s capabilities. This also provides India with an opportunity to present itself as a reliable and resilient destination for clean energy supply chains, as many firms may increasingly view China as risky.

India’s foray into the critical minerals sector necessitates the development of a skilled workforce and advanced technological expertise, areas in which the country is actively investing. India is collaborating with international partners, such as Australia and the US, to exchange knowledge and technology, as these countries have relatively more established expertise in critical minerals.

Socio-environmentally, mining operations pose significant risks, including habitat destruction, water pollution, displacement, livelihood losses, social unrest, and greenhouse gas emissions. Hence, India’s strategy will need to ensure fair distribution of benefits, protection of the rights of Indigenous communities, and engagement with local communities, which are crucial for the social acceptance of mining projects.

Mining projects (such as coal and iron) in India have caused socio-environmental damage in the past. In 2015, India’s Parliament amended the Mines and Minerals (Development and Regulation) Act 1957 to make a provision for establishing District Mineral Foundations (DMF) in mining-affected districts. A DMF is expected to “work for the interest and benefit of persons, and areas affected by mining-related operations”. These DMFs have been set up in 645 districts in 23 states.[9] However, the DMFs have been found to be ineffective due to corruption, bureaucratic control, and a lack of community engagement in some cases.[10] Having learnt lessons from these experiences, it is imperative that the central and state governments push for an equitable and inclusive energy transition through stringent social and environmental safeguards.

India is investing in research and development to innovate in extraction and processing technologies that are environmentally sustainable and cost-effective, especially considering India’s relative lack of financial resources in comparison to some of its Western partners. It has recognized the relevance of environmental, social, and governance (ESG) factors for critical mineral supply chains, with both the government and private players adopting environmental and social due diligence principles. In order to build sustainable and resilient supply chains, it is essential to understand the risks associated with mining in volatile or conflict-prone regions, as well as ecological risks such as climate change and water stress. These supply chains are indispensable for expediting the global energy transition. For instance, any mining activity in the Hindu Kush Himalayan region is fraught with socio-environmental risks, given the ecological vulnerability of the region and perennial cross-border tensions with both Pakistan and China.

Sustainable technologies become even more pertinent when considering India’s partnership with other developing countries such as Argentina and Chile, which face similar challenges when it comes to acquiring critical minerals. As reiterated by India during its G20 presidency in 2023, “reliable, diversified, sustainable and responsible supply chains for energy transitions, including for critical minerals”[11] are of paramount importance for countries in the Global South that continue to balance between environmental sustainability and energy security. Hence, as well as promoting North-South cooperation, India aspires to strengthen South-South collaboration, not only in upstream activities but also in downstream capacity-building and knowledge-sharing in best mining practices. Moreover, considering its place as the only developing country in clubs such as the MSP, it is imperative that it advances the interests of the Global South. This includes securing access to affordable supplies of critical minerals and energy; avoiding exploitative and extractivist market practices that marginalize the Global South; and ensuring predictability and stability in the supply chains that align with the equitable goals of the Global South.

The global nature of the critical minerals market means that India’s strategy is susceptible to geopolitical dynamics, including trade policies and political tensions. Amidst India’s tensions with China, it is also important to consider India’s high dependence on Chinese imports, coupled with the current paucity of these resources within Indian territory. China’s recent efforts to strategically leverage its dominance include actions such as restricting the export of gallium, graphite, and germanium (used in solar cells and electric cars) to the US in response to US export controls on certain types of advanced semiconductors to China. Such behaviour on China’s part also presents a challenge to India’s next steps. India would have to tread this path carefully in the short term, as diversification of supply chains cannot be achieved rapidly. In the event of countermoves by China, India would have to navigate the often complex policy landscape (such as protectionist policies) and leverage its newly established partnerships with countries in both the Global North and Global South to avoid supply chain disruptions.

Conclusions

While India has made several strides in its low-carbon development pathways in the past decade, its ambitious renewable energy targets, which form the backbone of its climate action strategy, depend on a reliable and sustainable supply of critical minerals. The current geopolitical landscape poses several challenges for India, particularly considering China’s dominance in the critical minerals supply chain and India’s own systemic rivalry with China. The complexity and uncertainty of the critical minerals supply chain are further intensified by other factors such as US-China strategic competition, the race to acquire critical minerals, and local human and ecological insecurities caused by the extractive industries. Similarly, as countries strive to transition to clean energy, the competition for these minerals is likely to intensify further, even if they have shared interests in spurring the global energy transition.

Clearly, the evolving geopolitical landscape underscores the importance of adaptability and collaboration in securing a sustainable future for critical mineral supply chains. Amidst these developments, India aspires to become self-reliant through enhanced domestic production, which requires immense financial and technological investment, which in turn builds expertise (knowledge) and capacity. At the same time, it seeks to build partnerships with other like-minded countries and forums/actors in the realm of global supply chain resilience – both in the Global North and the Global South. In contrast to the longstanding differences between India and the industrialized countries in climate change negotiations, the complementary interests in this area provide room for cooperation between India, the EU, the US, Australia, and other actors. This accentuates India’s characterization as a bridging power between the Global North and the Global South – advancing global energy transition interests in an equitable manner. In short, India’s critical minerals strategy has the potential to accelerate the achievement of its energy transition goals and enhance its geopolitical standing on the global stage.

Endnotes

[1] Confederation of Indian Industry (2023) “India’s Booming Electric Vehicle Industry”. CII Blog, 25 October 2023. https://www.ciiblog.in/indias-booming-electric-vehicle-industry/.

[2] Associated Press (2024) “India's clean energy boom slows as new solar projects get delayed. Experts say it can pick back up”. The Economic Times, 7 February 2024. https://economictimes.indiatimes.com/industry/renewables/indias-clean-energy-boom-slows-as-new-solar-projects-get-delayed-experts-say-it-can-pick-back-up/articleshow/107473996.cms?from=mdr.

[3] Gulia, Jyoti, Prabhakar Sharma, Nagoor Shaik and Vibhuti Garg (2023) “India’s Photovoltaic Manufacturing Capacity Set to Surge”. Institute for Energy Economics and Financial Analysis and JMK Research & Analytics, 3 April 2023. https://ieefa.org/articles/india-could-become-worlds-second-largest-solar-photovoltaic-manufacturer-2026.

[4] Kivimaa, Paula, Marie Claire Brisbois, Dhanasree Jayaram, Emma Hakala, and Marco Siddi (2022) “A socio-technical lens on security in sustainability transitions: Future expectations for positive and negative security”. Futures 141: 102971.

[5] Asian News International (2023) “India to auction lithium reserves found in Jammu and Kashmir by December: Mines secretary”. The Hindu, 2 May 2023. https://www.thehindu.com/news/national/india-to-auction-lithium-reserves-found-in-jammu-and-kashmir-by-december-mines-secretary/article66802920.ece.

[6] Government of India (2023) Thirty Critical Minerals List Released. Ministry of Mines, 24 July 2023. https://pib.gov.in/PressReleasePage.aspx?PRID=1942027.

[7] Warrior, Dhruv, Akanksha Tyagi, and Rishabh Jain (2023) “How Can India Indigenise Lithium-Ion Battery Manufacturing? Formulating Strategies across the Value Chain”. Centre for Energy, Environment and Water, 21 February 2023. https://www.ceew.in/publications/how-can-india-indigenise-lithium-ion-battery-cell-manufacturing-and-supply-chain.

[8] Roychowdhury, Anumita and Moushumi Mohanty (2023) “EV battery recycling can give wings to India’s decarbonisation dreams but faces stiff challenges”. Down to Earth, 20 November 2023. https://www.downtoearth.org.in/news/energy/ev-battery-recycling-can-give-wings-to-india-s-decarbonisation-dreams-but-faces-stiff-challenges-92899.

[9] Government of India (2015) District Mineral Foundation. Ministry of Mines. https://mines.gov.in/webportal/content/about-dmfpmkkky.

[10] Abhishek, Angad (2022) “DMFT fund audit in Jharkhand’s six districts flag ‘gross misuse’”. The Indian Express, 30 April 2022. https://indianexpress.com/article/india/dmft-fund-audit-in-jharkhands-six-districts-flag-gross-misuse-7895426/.

[11] Government of India (2023) G20 New Delhi Leaders’ Declaration. Ministry of External Affairs, 10 September 2023. https://www.mea.gov.in/Images/CPV/G20-New-Delhi-Leaders-Declaration.pdf.